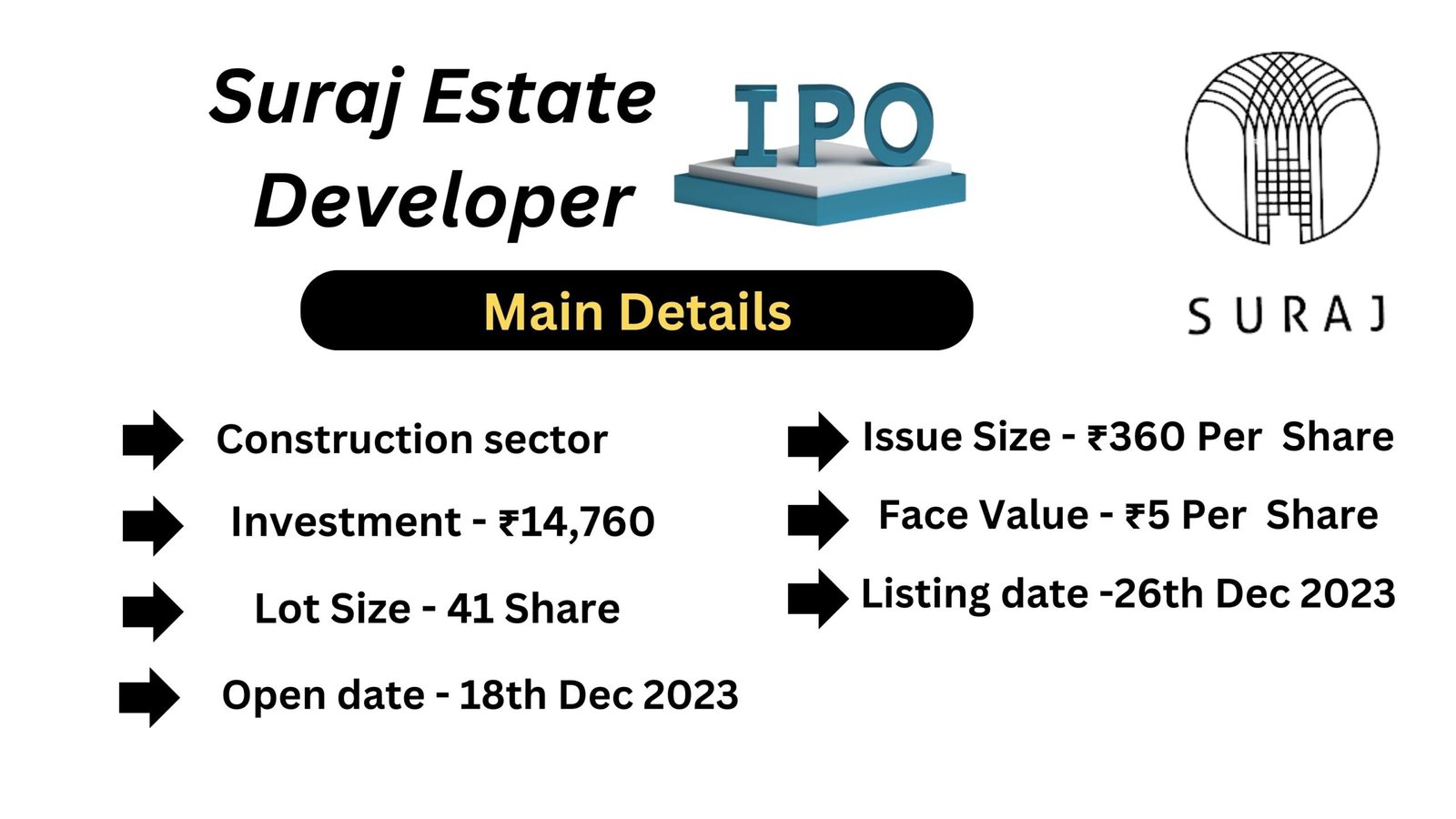

Suraj Estate Developer is set to launch its Initial Public Offering (IPO) in 2023, providing investors with an opportunity to own a stake in the company. The IPO details are as follows:

Suraj Estate Developer IPO Details

Company Overview

Suraj Estate Developer is a renowned real estate development company with a strong presence in the market. The company has a successful track record of delivering high-quality residential and commercial projects.

Suraj Estate Developers is a leading developer in South Central Mumbai, with residential properties in Mahim, Dadar, Prabhadevi, and Parel.

The company builds luxury properties in its residential portfolio, with values varying from Rs 10 million to Rs 130 million. As for the commercial segment, it has constructed corporate headquarters for companies such as Saraswat Co-operative Bank Limited, NSE, Union Bank, and Clearing Corporation of India (Dadar).

THE ISSUE:

The company is offering 77,77,777 fresh equity shares.

IPO Issue Size – ₹400.00 Cr

Minimum Investment – ₹14760

QIB – 29% (22,22,222 Shares)

NII (HNI) – 21% (16,66,666 Shares)

Retail – 50% (38,88,889 Shares)

Important Dates

Investors and prospective buyers should keep an eye out for the following important dates related to the Suraj Estate Developer IPO:

| Opening Date | 18th Dec 2023 |

| Closing Date | 20st Dec 2023 |

| Allocation Date | 21st Dec 2023 |

| Refund Initiation Date | 22nd Dec 2023 |

| Demat Transfer Date | 22nd Dec 2023 |

| IPO Listing Date | 26th Dec 2023 |

| Issue Price | ₹340- ₹360 Per Share |

| Lot Size | 41 shares |

| Face Value | ₹5 Per Share |

PURPOSE FOR THE IPO:

The funds raised from the Issue, which is the gross proceeds of the Issue after deducting the issue expenses (Net Proceeds), will be used for the following purposes:

- To repay or prepay the outstanding loans of their Company and Subsidiaries, i.e., Accord Estates Private Limited and Iconic Property Developers Private Limited.

- To acquire land or land development rights.

- For general corporate purposes.

Financial Information

| Period | 31 Mar 2023 | 31 Mar 2022 | 31 Mar 2021 |

|---|---|---|---|

| Total Assets | 140.69 | 64.93 | 32.76 |

| Revenue | 632.16 | 63.58 | 33.28 |

| Profit After Tax | 7.05 | 3.76 | 2.99 |

| Total Borrowing | 32.13 | 24.76 | 10.70 |

GMP PRICE:

| Date | IPO Price | GMP | Est. Listing Price |

|---|---|---|---|

| 24-Dec-2023 | ₹360 | ₹15 | ₹375 |

| 23-Dec-2023 | ₹360 | ₹15 | ₹375 |

| 22-Dec-2023 | ₹360 | ₹15 | ₹375 |

| 21-Dec-2023 | ₹360 | ₹25 | ₹385 |

| 20-Dec-2023 | ₹360 | ₹25 | ₹385 |

| 19-Dec-2023 | ₹360 | ₹70 | ₹430 |

| 18-Dec-2023 | ₹360 | ₹70 | ₹430 |

| 17-Dec-2023 | ₹360 | ₹70 | ₹430 |

| 16-Dec-2023 | ₹360 | ₹66 | ₹426 |

| 15-Dec-2023 | ₹360 | ₹55 | ₹415 |

| 14-Dec-2023 | ₹360 | ₹65 | ₹425 |

The prices shown here are for informational purposes only. We do not deal in grey market transactions, provide sub2 rates, or recommend trading in the grey market.